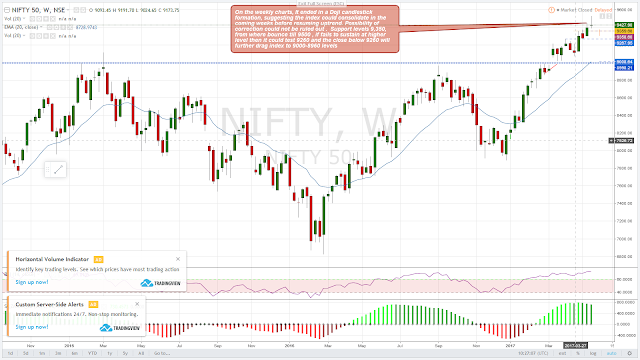

Nifty (9,427) - As evident from the weekly charts, the index ended in a Doji Bearish reversal Candlestick pattern post a rise, signaling the near-term top is in place. Considering, the candlestick structure, the likelihood of consolidation increases in the coming weeks before resuming the uptrend.

Also, the possibility of the short-term correction cannot be ruled if the Nifty closed below the low of Doji (9,387) next week. In such a scenario, Nifty will test 9,260. Any close, below the said level, would further drag Nifty to 9,000 & 8,960 levels. Above analysis, is based on the facts stated below. On analyzing the weekly charts, we observed, Nifty moved out of the multiple resistance zones (9,000), in mid-march 2017. Since then it has been trading on the higher side. It is the tendency of the prices, to pull back to the breakout point before the earnest move begins. In above case, level comes around 9,000. In addition, we have seen a steep rally from 7,900 (Dec 2016) up to 9,532. Hence, the possibility of index retracing the rally cannot be ruled out. 38.2 % Retracement levels of the rally lie around 8,910. However, the long-term bullish structure is intact; any dips can be used to add positions. Short-term positional traders are advised to trade cautiously. Above, technical set-up will be negated, once, we get weekly close above the high of doji (9,533).

Next week, buying may emerge at 9,360 levels and it could bounce till 9,480 and 9,500. These levels are to be watched out, if selling pressure is witnessed there, then there higher chances of Nifty breaching 9,360 and correcting further.

Comments

Post a Comment